Table of Content

The Good Neighbor Next Door Program is a US Department of Housing and Urban Development program that sells homes to first-time buyers at half-price. Good Neighbor Next Door is available to teachers, firefighters, law enforcement officials, and emergency medical technicians who want to live in the same community where they work. Buyers with low credit scores and small down payments get the largest interest rate adjustments on their Fannie- or Freddie-backed loans.

Some home buyers are eligible for 100% mortgages via the USDA and VA loan programs. We have access to several down payment assistance programs that can greatly lower the cash you need. All of our successful families spend between $2,000 and $2,500 total cash to get a home, depending on family income and the house purchased. That is total cash, including down payment and all loan closing costs. CalHFA partners with private sector mortgage lenders who qualify borrowers and offer the program to eligible first-time homebuyers in the state. The loan officers listed on the right side of this page are CalHFA’s top performing loan officers in 2011 in terms of the number of loans orginated in 2011.

Notice of Funding Availability (NOFA) for Community Development Block Grant (CDBG) and Emergency Solutions Grant (ESG)

With a little work we can help you enhance that credit and get a home loan. If you are looking to buy a house for the 1st time here are some basics you will want to know. When you are buying a house you are buying two things, a house and most importantly, a loan. This will take added work, but will save you tens of thousands and maybe keep you from losing your house.

Buyers with high credit scores get significant adjustments, too. Each post is edited and fact-checked by industry experts to ensure that we are providing accurate information for our readers. • If income from SSI, SSA, DISABILITY, or RETIREMENT, then a copy of the Award Letter and copy of recent check, if not Direct Deposit. The realtor.com® editorial team highlights a curated selection of product recommendations for your consideration; clicking a link to the retailer that sells the product may earn us a commission. Finding it hard to pick among these many financial aid options?

First-Time Home Buyer Tax Credit

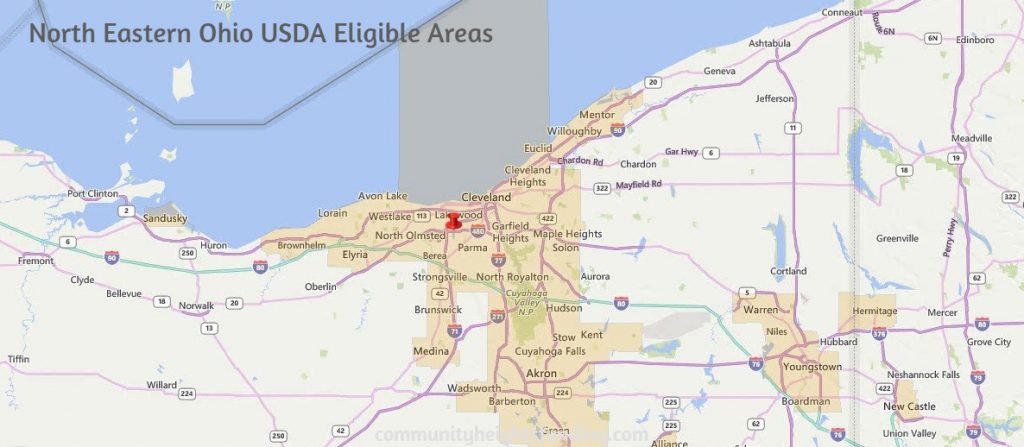

The income-based USDA loan program insured by the US Department of Agriculture helps first-time homebuyers in rural locations to purchase their dream homes with zero down. CalHFAand many cities and counties in California offer first-time homebuyers the Mortgage Credit Certificate program. Contact CalHFA or your local county or city to access the first-time homebuyer tax credit program.

In addition to seeing if you qualify as a borrower, properties must meet certain CalHFA standards, too.

Community Development Services

That's why CalHFA offers several options for down payment and closing cost assistance. This type of assistance is often called a second or subordinate loan. CalHFA's subordinate loans are "silent seconds", meaning payments on this loan are deferred so you do not have to make a payment on this assistance until your home is sold, refinanced or paid in full. STAND has partnered with San Joaquin County’s Neighborhood Preservation Division to Provide qualified buyers GAP Loans. These loans provide deferred down payment assistance loans to low income, first time home buyers.

The CalHFA VA program is a VA-insured loan featuring a CalHFA fixed interest rate first mortgage. CalHFA offers a variety of loan programs to help you purchase a home in California. The First-Time Home Buyer Tax Credit Act is working its way through Congress. The first-time buyer program would refund up to $15,000 in tax liability to first-time home buyers retroactively to December 31, 2020. Deferred mortgages are available for up to $25,0000 via municipal governments and local foundations.

Purchase a home with zero down and no private mortgage insurance. The Emergency Repair Program provides one-time emergency repair assistance to low-income property owners. CalHFA Zero Interest Program, also known as ZIP, is a second mortgage that can work with certain CalPLUS loans. The program makes homeownership more affordable for low-income buyers by providing borrowers with a zero-interest loan amounting to 3% of a borrower’s first mortgage. The CalHFA FHA Program is an FHA-insured loan featuring a CalHFA 30 year fixed interest rate first mortgage. The City of Stockton has released a NOFA for CDBG and ESG funds.

Loans are provided at one percent (1%) simple interest, assumable by qualified low-income buyers or heirs, and due upon the sale of property or transfer of ownership. When in doubt, ask your loan officer or real estate agent for guidance. “Sometimes, California Housing Finance Agency loans can be combined with other assistance offers, while others can’t,” says Tony Mariotti, a licensed real estate agent and the CEO of RubyHome in Los Angeles. Here is a list of home buyer eligibility requirements to help you understand whether or not you qualify for these loans.

You can complete our entire loan pre-qualification process over the phone within just 10 minutes. At the same time, homes in Stockton are affordable, allowing you to enjoy the advantages of the region without the high costs that you might find in nearby cities. Here are the options, who qualifies, and how the programs work. The Corporation for Enterprise Development maintains a national Individual Development Account Directorywhere you can search for a local IDA or Matched Savings program near you. Review the guidelines below for both Borrower and Property Requirements to determine if you may be eligible to apply for the CalHFA FHA Program.

They have the most experience with the typical working class Stockton family buying their first home. Following are some lenders that we have had a lot of excellent experience working with and highly recommend their services. Thank you for visiting our first time home buyer programs website. Please contact us with any questions or comments about our first time home buyer programs products or services. Home equity has proven to be one of the strongest ways for families to build and pass on intergenerational wealth and CalHFA is committed to improving equitable access to homeownership for all Californians. The CalHFA USDA Program is a USDA Guaranteed first mortgage loan program, which can be combined with the MyHome Assistance Program .

To make that possible, we offer free consultations, free credit counseling, Par pricing, and some of the area’s lowest rates. Since this program is a deferred-payment junior loan, there’s no need to pay it back until you sell or refinance the property. In many cases, you can combine MyHome Assistance with CalHFA’s loan programs, including FHA, USDA, VA, and conventional loans.

Our advice is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website. If you are concerned about affording your closing costs, we offer a solution in the form of an optional lender credit to cover closing costs up to 3% of the total loan amount. A conventional mortgage also be an excellent choice for a first-time homebuyer. Some conventional home loans are available with down payments as low as 3%. For veterans, active-duty service members and eligible surviving spouses, we have the VA loan program insured by the Department of Veterans Affairs .

No comments:

Post a Comment